·

Home ·

News Center ·

News ·

·

Home ·

News Center ·

News ·

2024.08.08

2024.08.08The industry reshuffle is accelerating.

01

The first city of new energy vehicles has changed hands again.

Recently, various regions announced economic data for the first half of 2023. Shanghai's GDP reached 2.13 trillion, a year-on-year increase of 9.7%, far exceeding Beijing's 2.06 trillion, and firmly maintained its position as China's largest economic city.

Among them, in the first half of 2023, Shanghai's new energy vehicle production was 611,500 vehicles, a year-on-year increase of 65%, and the output value of the new energy vehicle industry increased by 69.8%, becoming the largest contributor to industrial and even economic growth.

At the same time, Shaanxi Province released its industrial data for the first half of the year, with a total automobile production of 611,000 vehicles in the province, of which 430,000 were new energy vehicles, accounting for 11.9% of the national new energy vehicle production.

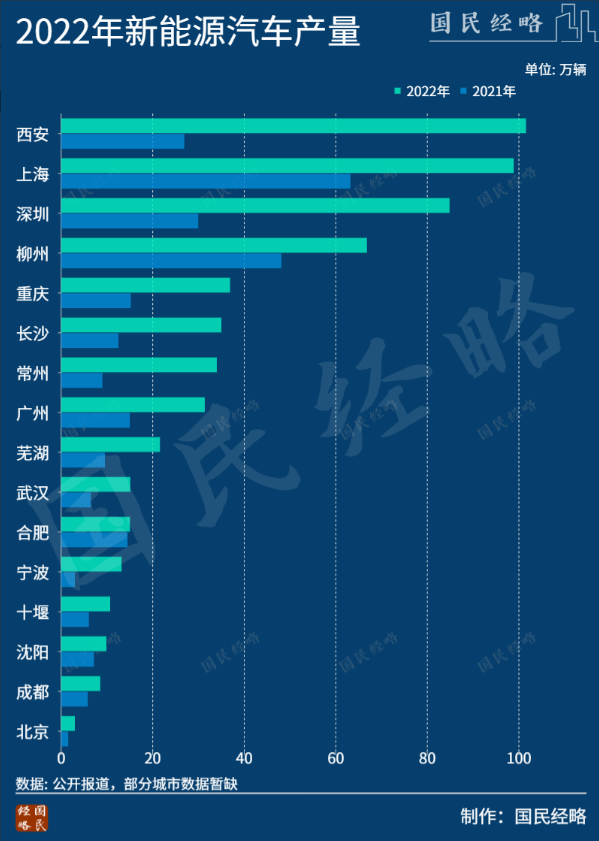

As a newly emerging automobile industry province, Shaanxi's new energy vehicles are almost all produced in Xi'an, which means that Shanghai has surpassed Xi'an with a large lead and returned to the position of the largest new energy city.

As we all know, since last year, due to unexpected factors such as masks, Shanghai once lost its position as China's largest economic city, and the crown of the first new energy city and China's largest industrial city also changed hands.

The first "temporary" overtaken is Beijing. In the first half of last year, Beijing's semi-annual GDP surpassed Shanghai by a slight advantage of 300 million yuan, which was rare, but this situation did not last long. Shanghai completed the overtaking that year, and in the first half of this year, it expanded its lead.

The second "dark horse" is Xi'an. In 2022, Xi'an's new energy vehicle production will reach 1.0152 million units, a year-on-year increase of 2.77 times, exceeding Shanghai's 990,000 units, and ranking first in the country for the first time, but this leading trend did not last for a year.

The last "breakout" is Shenzhen. In 2022, Shenzhen's total industrial output value above designated size will reach 4.55 trillion yuan, and its industrial added value will reach 1.13 trillion yuan, both exceeding Shanghai, and for the first time becoming the largest industrial city in China. (See "China's largest industrial city has changed hands")

Now, without the impact of unexpected factors, Shanghai's economy is rebounding.

Returning to the first city of new energy vehicles is just the beginning, and it may not be impossible to regain the first industrial city by the end of the year.

02

Why was Xi'an overtaken by Shanghai?

Xi'an's sudden rise in the new energy vehicle industry was one of the most watched events last year.

In the battle for the capital of new energy vehicles, Shanghai, Shenzhen, Guangzhou, Hefei, Chongqing, Liuzhou, Changzhou and other places exist as trendsetters, while Xi'an has never been prominent.

In fact, a few years ago, almost no one would associate Xi'an with new energy vehicles. In the impression of many people, this is an ancient historical city and a major tourist city, and it seems to have nothing to do with a strong industrial city.

However, Xi'an quietly laid out the new energy vehicle industry, and finally ushered in a big explosion, and won the championship for the first time in 2022.

All this dates back to 2003. That year, BYD acquired Xi'an Qinchuan Automobile to obtain a car license, and was able to officially enter the automobile manufacturing track, becoming the second private car company after Geely.

Reciprocity and mutual achievement. When BYD took advantage of the new energy wave to take off, Xi'an, which was the first to deploy, naturally became the biggest beneficiary. At its peak, half of BYD's production came from the Xi'an factory.

In fact, although BYD's headquarters is located in Shenzhen, its automobile production bases are spread all over the country, and Xi'an is the largest one among them. It is also the largest source of new energy vehicles in Shaanxi, without a doubt.

Data shows that in 2022, the entire Shaanxi produced 1.02 million new energy vehicles, of which BYD accounted for 97%;

In the first half of this year, Shaanxi's new energy vehicle production was 430,000, of which the BYD factory in Xi'an accounted for 86%.

It can be seen that Xi'an and BYD are deeply tied together, and they can be said to prosper together. Similarly, once BYD encounters challenges from new forces, Xi'an will naturally be impacted.

To put it another way, even if BYD still moves forward courageously and is not afraid of challenges, a Fortune 500 company will not put all its eggs in one basket.

According to incomplete statistics, BYD is forming 10 production bases across the country, including Xi'an, Shenzhen Pingshan, Changsha, Changzhou, Fuzhou, Hefei Changfeng, Jinan, Zhengzhou, Xiangyang, and Shenshan Cooperation Zone, with an overall planned production capacity of more than 4 million vehicles.

In fact, BYD has maintained high growth this year, but due to changes in best-selling models, the focus of production growth is not in Xi'an, but in other production bases, which also leads to a lower growth rate of new energy vehicle production in Xi'an than in other cities.

BYD's dominance is the biggest support for Xi'an's success, but it has also become one of the constraints for long-term development.

You should know that there is not only one Tesla in Shanghai, and there is no Xpeng in Guangzhou. Not to mention how strong the confidence of SAIC Group and GAC Group is, in addition to many complete vehicle factories in Shanghai and Guangzhou, there is also an upstream and downstream industrial chain consisting of thousands of automobile companies, thus building a strong industrial moat.

In contrast, according to the analysis of the First Financial Daily, Shaanxi has only a few new energy vehicle manufacturers such as BYD and Geely, and there are only 126 major automobile parts supporting enterprises, among which supporting the production of new energy vehicles has become the biggest shortcoming of Xi'an.

Therefore, from "the first city in new energy vehicle production" to "the first city in new energy vehicle industry", Xi'an still has a long way to go.

03

Any industrial transformation will not be smooth sailing, but fierce competition is the norm.

As another 10 trillion-level industry second only to real estate, the automobile industry has a far greater impact on the urban structure than general industries. Therefore, it has become a competition track for almost all cities, and the market has long turned from a blue ocean to a red ocean.

In recent years, at least dozens of cities across the country have made new energy vehicles their leading industry, but a number of companies and cities have already failed.

According to statistics from China News Weekly and other institutions, there were as many as 487 electric vehicle manufacturers in China in 2018, but by 2023, there will be only more than 40 new energy vehicle companies that can operate normally, and more than 400 car companies have been reduced in just five years.

Affected by this, a number of cities that once made great strides in the field of new energy vehicles have to press the pause button.

According to Sohu City, at least more than 10 cities including Wenzhou, Rugao, Shangrao, and Ordos have encountered the embarrassment of project suspension or unfinished projects. Only a few have been successfully revitalized, and most have been silent.

Behind this, as a fully competitive industry, new energy vehicles are challenging the forces of traditional fuel vehicles while also facing a "life-and-death" battle within themselves.

Since 2023, the reshuffle of new energy vehicles has accelerated, and two major factors have directly entered the knockout stage of this competition.

First, subsidies for new energy vehicles have begun to decline, and some car companies that rely too much on government subsidies may lose their market competitiveness.

According to statistics released by the Ministry of Industry and Information Technology, from the start of the policy in 2010 to 2020, subsidies for new energy vehicles have exceeded 152.1 billion yuan, covering at least 3.17 million vehicles.

However, at the beginning of 2023, national subsidies for new energy vehicles began to officially withdraw from the stage of history.

Although the purchase tax exemption is still continuing and local subsidies still exist, the absence of subsidies is the time to truly test the market competitiveness of new energy vehicle companies.

Second, the national new energy vehicle production capacity has begun to saturate, and even a phased surplus has appeared, and "price wars" have emerged one after another.

According to the book "China's Urban Great Changes", the rapid growth of new energy vehicles in the past few years has been based on the cannibalization of traditional fuel vehicles, but the overall national automobile sales have remained stagnant.

Now, when the planned production capacity of new energy vehicles exceeds 20 million vehicles, and the penetration rate is expected to exceed 50% by 2025, it is far beyond the official planning target of "the proportion of new energy vehicle sales in my country will reach 20% in 2025".

Once the market changes from an incremental market to a stock market, the "fight" between car-making forces is inevitable.

Not to mention the far-reaching impact of the decline in subsidies and overcapacity, a big price cut by Tesla has triggered a big "stampede" of domestic brands, and many companies may not survive 2023.

Once the market turns, it is possible that the number of vehicles in some cities will drop from millions to single digits, and the automobile industry will change from a pillar industry to a drag industry.

Who will have the last laugh in the great urban changes caused by this industrial transformation? We will wait and see.